The Financing Process

Demystifying Home Loans

Navigating the Greene County mortgage market is simpler with the right expertise. We connect you with trusted local lenders to guide you from initial pre-approval to the final closing.

Why Professional Guidance Matters:

Expert Oversight: Stay informed at every milestone of the home loan process.

Customized Care: Consult with mortgage specialists to secure terms that fit your financial goals.

Simplified Experience: Reduce the stress of financing with a clear, step-by-step roadmap.

Step One:

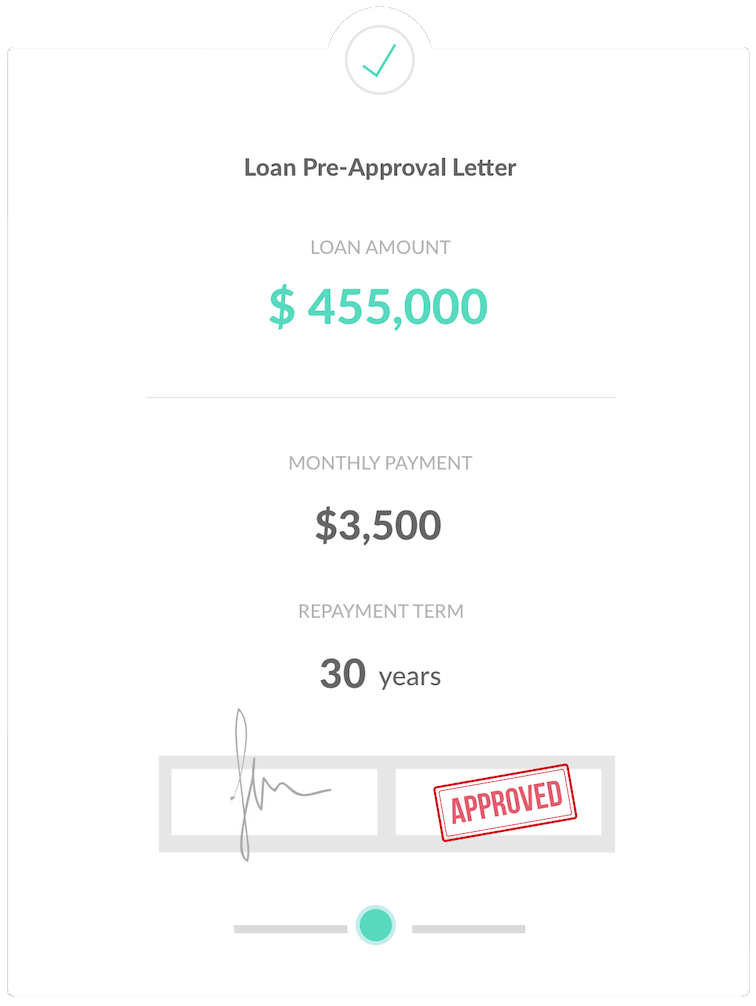

Get Pre-Approval

In a competitive market, a pre-approval letter is your strongest negotiating tool. It proves to sellers you can close, often leading to faster response times.

What You’ll Need (2026 Checklist):

Income Verification: Recent pay stubs (30 days) and W-2s/1099s (2 years).

Asset Proof: 60 days of bank statements and retirement account summaries.

Identity & Credit: Driver’s license and a soft credit pull (doesn't impact your score).

Pro-Tip: Submit all applications within 45 days to ensure they count as a single credit inquiry.

Estimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)Private Mortgage Insurance (PMI)

$0.00

(0.0%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)

Step Two:

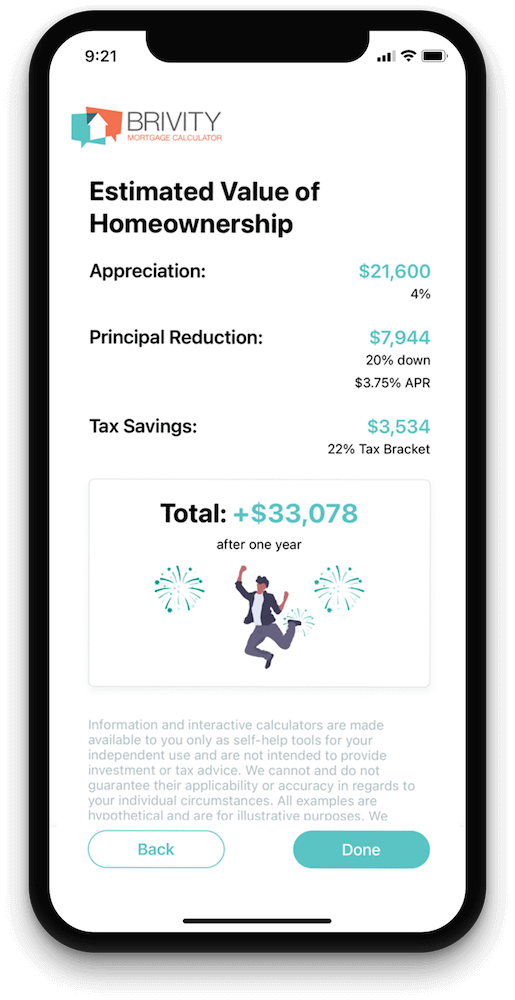

Find the best loan

Not all mortgages are equal. Partnering with a top-notch local loan officer ensures you access programs—like FHA, VA, or Conventional—that align with your goals.

Complete This Form to get connected with our network of local specialists and view today's competitive Greene County rates.

Step Three:

How Do Application and Processing Work?

Your lender will help you finalize your full mortgage application, review down payment options, and provide a clear breakdown of related closing fees.

To protect your investment, the lender orders two critical reports:

Home Appraisal: Verifies the property value matches the loan amount.

Title Search: Confirms the property is free of legal liens or ownership disputes.

An underwriter reviews your entire loan package to ensure it meets 2026 compliance regulations. Be prepared to provide additional documentation or clarification quickly to keep your closing on track.

Step Four:

Signing and finalizing the deal

Once your loan is approved, the final phase involves securing insurance, signing legal documents, and official recording. In 2026, many of these steps can be completed via certified digital platforms for a faster "keys-in-hand" experience.

Phase 1: Proof of Insurance & Final Walk-Through

Before funding, lenders require proof of homeowners insurance. Conduct a final walk-through within 24 hours of closing to ensure the property condition matches your agreement.

Phase 2: Signing & Closing Funds

At the closing—typically held at a title company or attorney's office—you will sign the Closing Disclosure (CD), promissory note, and deed of trust. You must provide closing funds via wire transfer or cashier's check.

Phase 3: Recording & Ownership

After signing, your documents are sent for official recording with the county. Once this process is complete, ownership is officially transferred, and you receive the keys to your new home.

After the loan goes through the required recording process, the purchase is complete, and you officially own your new home!